Does Renter’s Insurance Cover Water Damage?

Renter’s insurance policies typically cover accidental water damage such as water leaks or burst pipes, but not damage from basement floodingFlooding is the overflow or accumulation of water in areas t... More or natural disasters. However, most renters insurance policies do not cover damages caused by floodingFlooding is the overflow or accumulation of water in areas t... More or sewageSewage is wastewater containing biological and chemical cont... More water, unless you paid for an extra add-on to your standard policy.

Does Renter’s Insurance Cover Water Damage?

Let’s explore what types of water damage are covered by renters insurance, and when you may need additional policies like flood insurance or water backup coverage.

- Bad Weather:

Most insurance companies cover the damage done to your personal belongings that may be due to inclement weather such as windstorms, lightning, hail, snow, ice, or sleet. This means if your apartment experiences water damage from a sewageSewage is wastewater containing biological and chemical cont... More line, or flooded basements, standard renters insurance won’t cover it unless you purchase extra coverage. Most of the time, earthquakes and floods are not covered and you would need to get an additional policy for that coverage. You should also understand how renters insurance claims for water damage work—especially if water leaks affect a neighboring unit. This means if you leave a window open during a storm, you are responsible for fixing it.

- Accidental Discharge of Water:

If it happens that you have an overflow or discharge of water in your home from a leaky appliance, burst pipe, water leak from your roof, or if water leaks to another unit from yours that causes damage to their property, that would be covered by your policy. However, if you do notice issues with piping, cracks in the wall, or something similar, you should make your landlord aware before further damage happens. To protect your belongings and avoid denied claims, document and report any water leak damage right away, including hidden ceiling leaks or moldMold is a type of fungus that grows in damp or humid conditi... More risks.

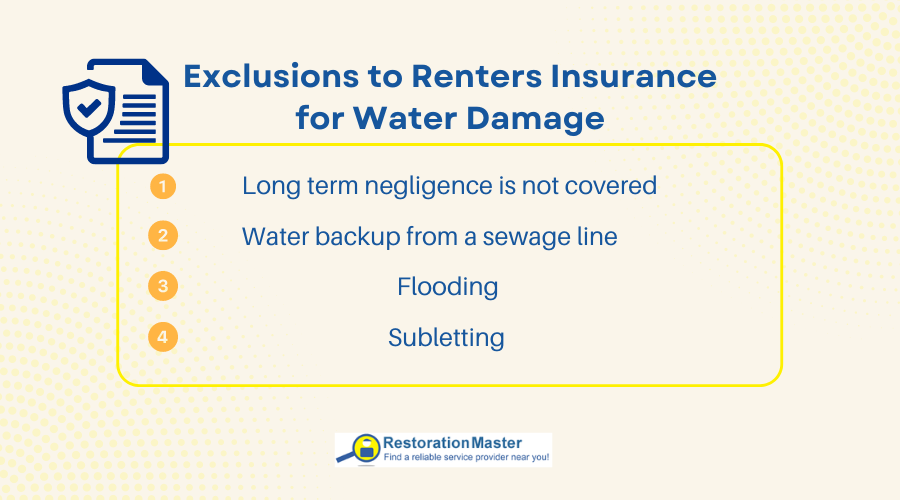

Exclusions to Renters Insurance

Be aware that long-term leaks and negligence-related water damage are typically not covered by renters insurance. For example, if you have floodingFlooding is the overflow or accumulation of water in areas t... More or sewageSewage is wastewater containing biological and chemical cont... More backup, typical renters insurance is not likely to cover the damage. Here are a few things to be aware of when it comes to exclusions to renter’s insurance:

Long term negligence is not covered:

Renter’s insurance covers accidental damage and does not cover any damages you’ve done yourself due to negligence or reckless behavior.

Water backup from a sewage line:

Usually, this type of damage is considered an add-on that needs to be purchased separately from the standard renter’s policy.

Flooding:

Renters insurance does not cover floodingFlooding is the overflow or accumulation of water in areas t... More, so if you live in a basement apartment or flood-prone area, you’ll need separate flood insurance. If you live in a flood zone make sure to purchase flood insurance.

Subletting:

If you sublet your rental, be sure to check if your renters insurance policy covers water damage in subletting situations, or if coverage is voided.

The point of renters insurance is to cover your personal property. However, your landlord is responsible for the following damages when it comes to the property:

- Plumbing

- Damage to the structureStructure refers to the framework or components of a buildin... More

- Electrical systems

- Appliances

Even if you are fully aware of what your renters policy covers, you should always check your policy on coverage when it comes to water damage. Most renters insurance policies cover only personal belongings and that includes things like jewelry, appliances, TVs, and laptops. For example, if your apartment has water damage and it is unlivable, your renters insurance should cover your living expenses, rental costs while you find a new apartment, and relocation costs such as laundry, food, etc. Always review your policy to see if it includes water damage coverage for issues like water backup, roof leaks, and overflowing appliances.

Should I Purchase Renter’s Insurance?

Renters insurance will protect your personal belongings so that you do not have to replace them yourself in case something happens to them. Some landlords may require you to carry renters insurance, especially in areas where pipe bursts, water leaks, or basement floodingFlooding is the overflow or accumulation of water in areas t... More are common. A lot of landlords now require you to purchase renters insurance as a part of the rental agreement.

Before purchasing renters insurance, you should create a home inventory list. This list will include all the items you own and details about them such as makes, models etc. Also, it should include their cost. This will help greatly with processing your claim and payout from your renters insurance company.

Something to be aware of before filing a renter’s policy insurance claim is your deductible. If the cost of the belongings that were damaged is less than the deductible, you should think about whether it is worth for you to file the claim as your insurance will not pay out anything below a deductible and your insurance premium may go up after filing a claim.

If you are facing water damage at your property and you need water damage restoration, call the professionals for water mitigation services. Highly trained technicians will clean, dry, and restore your property using hi-tech equipment while providing quality service. Calling a professional to deal with water damage as soon as it happens will limit the extent of the damage so you won’t have to file a large insurance claim.