What You Need to Know before Buying a House with Water Damage

So, you’ve found your dream home, but it has sustained water damage. What are you going to do?

When on the hunt for a new home, you may be faced with a difficult dilemma – to buy or not to buy a water damaged house that you really like and can easily afford. Even if it is just the home you’ve been looking for – a great house that suits your lifestyle and meets all your needs and preferences (size, layout, interior design, location, etc.), you may be afraid of potential loss and unwilling to buy a property affected by water damage.

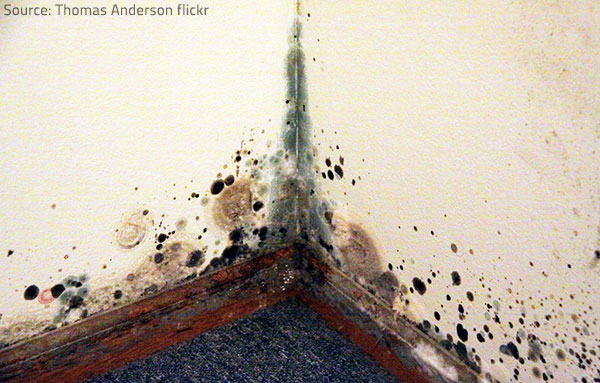

Buying a house with water damage is a risky investment indeed. The water may have caused considerable structural faults and safety hazards in the home, such as unsound walls and moldMold is a type of fungus that grows in damp or humid conditi... More, and the problems may continue even after the existing damage has been mitigated, especially if the source of the damage has not been properly identified and correctly fixed. Yet, you can easily avoid most of the risks and make sure your investment will be worth it, if you know what to look for and what precautions to take before closing the deal on a water damaged house.

Your first step is to determine the extremity of the damage and the costs for the necessary repairs.

Schedule a Home Inspection

Should I buy a house with water damage? To be able to answer this decisive question, you need to find the answers to several other crucial questions first:

- What is the source of the water damage? An overflowed river, a burst pipe, a leaking roof?

- How much damage was done? For how long was it present before it was noticed?

- What actions were taken? Was the source of the problem fixed? How was the damage addressed (structural repairs, mold remediationMold remediation is the process of identifying, removing, an... More, etc.)? Were the plumbing, electrical, and HVAC systems examined for potential problems?

- Who performed the restorationRestoration is the process of returning a property to its pr... More works (if any)? Are there reports available to show details about the restorationRestoration is the process of returning a property to its pr... More process – what work was done, what the final results were?

- Was any testing done to ensure that the water source was fixed, all structural damage was repaired, and all moldMold is a type of fungus that grows in damp or humid conditi... More was removed?

- Who paid for the restorationRestoration is the process of returning a property to its pr... More works? If it was the home’s insurance company, will it cover any additional or future problems related to the water damage?

Water damage may result in structural faults and safety hazards in the home, such as unsound walls and moldMold is a type of fungus that grows in damp or humid conditi... More growth.

You can ask the current owner of the house (or the real estate agency you’re working with) all these questions, of course, but you’re strongly advised to have the home inspected by a certified professional as well, so that you get correct and comprehensive information before you consider bidding.

A professional home inspectionInspection is the careful examination and assessment of a pr... More will establish the extent and cause of the water damage. The experienced specialists will know what to look for and will be able to spot any hidden damage and potential dangers – mold growth, foundation cracks, leaking windows, faulty pipes, etc. Once you get a detailed water damage inspectionInspection is the careful examination and assessment of a pr... More report, you’ll know exactly what you’re dealing with and will be able to make an informed decision about whether to buy the property or not.

Good to remember:

- Make sure you request copies of all home inspectionInspection is the careful examination and assessment of a pr... More reports.

- Make sure the house is thoroughly checked for moldMold is a type of fungus that grows in damp or humid conditi... More and dry rot (the most common results of water damage). Both these harmful microorganisms are difficult to detect, can easily spread to other materials, and may cause considerable structural damage and severe health issues. Your hired inspectors will have to look behind wallpaper, under carpeting, and inside small crawl spaces in order to detect hidden water damage. In certain cases, they may need to open walls or perform some specialized tests to determine the extent of the damage. Only experienced and reliable professionals who specialize in mold remediation and wood construction will be able to detect all the potential hazards and ensure your peace of mind.

Consult a Contractor and Get an Estimate

Once the inspectionInspection is the careful examination and assessment of a pr... More has been completed, you can get an assessment of how much the necessary repairs are going to cost.

To get an accurate idea of the final restorationRestoration is the process of returning a property to its pr... More costs, you need to contact at least three or four contractors who have experience in water-damage repairs. Give them a copy of the home inspectionInspection is the careful examination and assessment of a pr... More report and ask them for an estimate that includes the cost of fixing the cause of the water damage, repairing the sustained damage, and remediating any moldMold is a type of fungus that grows in damp or humid conditi... More issues.

You need to know the extremity of the damage and the costs for the necessary repairs before making a bid on a water damaged house.

Have each of the contractors evaluate the home and assess the damage on site, if possible. Keep in mind that you need a written permission from the homeowner if the contractor has to open up any wall areas or perform intrusive tests to check for problems related to water damage.

You’re going to need the professionals’ estimates in order to make a prudent bid to the seller.

Evaluate the Repair and Remediation Costs and Submit Your Bid

Water damage in a house is quite a serious matter. It may have caused significant moldMold is a type of fungus that grows in damp or humid conditi... More issues and severe structural problems to the property you intend to buy (water can easily seep through the walls and soak the drywall, insulationInsulation is a material used in buildings to reduce the tra... More, and structural supports, especially if the problem has been unattended for a prolonged period of time). The restorationRestoration is the process of returning a property to its pr... More process may take plenty of time and effort and cost you a pretty penny.

Therefore, when placing a bid on a water damaged house, you need to factor in the cost of water damage restoration and mold remediationMold remediation is the process of identifying, removing, an... More:

- Get the market value of the home (ask several local real estate agencies for the costs of other similar houses in the same area);

- Carefully review the home inspectionInspection is the careful examination and assessment of a pr... More and contractor reports and calculate the average cost for repairing the water damage in the house;

- Subtract the estimated water damage repairRepair is the act of fixing or restoring damaged property, m... More cost from the home’s market value. The resulting figure will show you the amount you should bid on the house (however, you may want to make a lower offer at first in order to open negotiations with the seller).

Once you get all the facts and numbers, you should consult with your real estate agent. It may be possible to work the restorationRestoration is the process of returning a property to its pr... More costs into the offer, negotiate price reduction, or have the seller make certain repairs before the offer is finalized.

Good to remember: Make sure the water damage repairRepair is the act of fixing or restoring damaged property, m... More costs are explicitly included in the bid presented to the seller.

When a final deal has been agreed upon, request a copy of the sales contract and double-check if the clauses regarding water damage costs are correct. Consult an attorney if you are unsure about any terms or conditions in the contract.

Obtain Homeowner’s Insurance Quotes

There is one last thing to consider before closing the deal – review your insurance options and see if you can get the right coverage for your new home.

Protect your investment well.

When buying a house with moldMold is a type of fungus that grows in damp or humid conditi... More and water damage, your best bet is to get a comprehensive policy. Talk to several local insurance agencies and find out whether you’ll be covered if issues related to previous water damage return. Also, ask about any special considerations or unusually high prices for insuring a home with a history of water damage. If insurance is very expensive or coverage is very limited (or unavailable), the house may not be a wise investment.

If the house you intend to buy is located in a flood plain or in a region with a high risk of water damage, you may want to purchase additional flood insurance (most general home insurance policies do not cover floods). Ask the real estate agent you’re working with for a list of local agencies that provide flood insurance or ask other homeowners in the area for recommendations.

Once you and the current owner of the house agree on all the details, you can finally close the deal. Sign the necessary paperwork and begin water damage restoration without delay – waiting will result in further damage to the house and will cost you extra time and money. Just make sure you find experienced and trustworthy water damage professionals to take care of your new property and restore it to an excellent condition, so that you can move in as soon as possible.