The Ultimate Guide to Flood Insurance: Costs, Coverage, and Protection

FloodingFlooding is the overflow or accumulation of water in areas t... More is one of the most stressful and damaging events a homeowner can experience. From sudden spring storms to melting snow and overflowing rivers, water damage can happen anywhere, and it is often more costly than people expect. Many homeowners assume that their standard insurance policy will protect them, but flood damage is typically excluded.

This guide provides everything you need to know about flood insurance costs, coverage options, and strategies to protect your home. By the end, you will understand how to make informed decisions and be prepared before a disaster strikes.

Why Flood Insurance Is More Important Than You Think

You might think, “I live nowhere near a river or the coast—I’m probably safe.” But the truth is, floods can happen anywhere. According to FEMA, about 20% of flood insurance claims come from homes in areas considered low- to moderate-risk. Even a small flood can cost tens of thousands of dollars to repairRepair is the act of fixing or restoring damaged property, m... More.

Here’s why flood insurance is essential:

- Just one inch of water inside your home can cause over $25,000 in damages—from flooring and walls to electrical systems and appliances.

- Most standard homeowners’ insurance policies do not cover floodingFlooding is the overflow or accumulation of water in areas t... More caused by rivers, storm surges, or groundwaterGroundwater is water that exists beneath the earth’s surfa... More. They typically only cover damage from rain or plumbing failures.

- Flood insurance provides a safety net for both your home’s structureStructure refers to the framework or components of a buildin... More and your personal belongings, so you don’t have to bear the cost alone.

In short, flood insurance isn’t about fearing the worst—it’s about being prepared.

What Causes Flooding?

FloodingFlooding is the overflow or accumulation of water in areas t... More doesn’t just happen near lakes or rivers. Many factors can trigger water damage in your home, including:

- Heavy rainstorms: Intense or prolonged rain can overwhelm drainage systems and flood homes, streets, and basements.

- Snowmelt: Rapid melting in spring can raise water levels in rivers, streams, and low-lying areas.

- Flash floods: Sudden, intense floods that occur in a matter of hours, often after thunderstorms.

- Mudflows and debris floods: Burned hillsides or landslides can channel water and debris into neighborhoods.

- Urban floodingFlooding is the overflow or accumulation of water in areas t... More: Clogged storm drains, concrete surfaces, and insufficient drainage can cause unexpected floodingFlooding is the overflow or accumulation of water in areas t... More even far from rivers.

For practical steps to protect your home from indoor floodingFlooding is the overflow or accumulation of water in areas t... More during storms, check out this helpful guide: How to Prevent Indoor Flooding from Storms

What Does Flood Insurance Cover?

Flood insurance is available through the National Flood Insurance Program (NFIP) as well as through some private insurers. Policies are generally divided into two main types of coverage: building coverage and contents coverage.

Building Coverage

Building coverage protects the physical structureStructure refers to the framework or components of a buildin... More of your home. This includes walls, flooring, foundations, roofs, plumbing, electrical systems, and HVAC units. It also covers built-in appliances, cabinets, and other permanent fixtures. With this coverage, major repairs after a flood are handled by your insurance, helping you avoid significant out-of-pocket expenses.

Contents Coverage

Contents coverage protects your personal belongings inside the home. This can include furniture, clothing, electronics, appliances, valuables, and important documents. Contents coverage is optional and may have coverage limits. Many homeowners assume their policy covers all belongings, but without this protection, personal items could be damaged or lost without reimbursement.

Policy Limits and Waiting Period

Standard NFIP policies typically provide up to $250,000 in building coverage and $100,000 for personal property. For homes with high-value structures or expensive belongings, additional private coverage may be necessary. It is also important to note that most flood insurance policies have a 30-day waiting period before coverage takes effect. Purchasing your policy early ensures your home and possessions are protected well before the rainy season or any potential storms.

For more details on specific scenarios, like water damage from burst pipes, check out our guide on Does Flood Insurance Cover Pipe Bursts?

How Much Does Flood Insurance Cost?

Flood insurance costs can vary depending on several key factors. Here’s a breakdown to help you understand what influences your premium:

Flood risk of your area

- Homes in high-risk flood zones generally pay more.

- Example: A home near a river or in a FEMA-designated flood zone could have an annual premium exceeding $2,000.

- Homes in low-risk areas may pay as little as $150–$200 per year.

Home elevation and foundation type

- Homes built above the base flood elevation or with flood-resistant features often have lower premiums.

- Example: Elevating HVAC systems and electrical panels can reduce your yearly cost.

Coverage limits and deductibles

- Higher deductibles lower your annual premium but increase what you pay out-of-pocket if you file a claim.

- Example: Choosing a $5,000 deductible may reduce your premium by several hundred dollars per year.

Home age and construction

- Newer homes built with modern, flood-resistant materials typically have lower insurance costs.

- Older homes may require additional measures or have higher premiums due to higher risk.

Typical Annual Cost Examples

- Nationwide average for a single-family home: $500–$700 per year

- Low-risk area home: $150–$200 per year

- High-risk area home: $2,000 or more per year

Real-World Perspective

- Even a small flood can cause tens of thousands in damage. The average flood insurance claim in recent years was approximately $34,000.

- Paying a few hundred or thousand dollars for coverage is far less expensive than handling flood damage entirely on your own.

Flood Insurance Costs by Location

Flood insurance premiums can vary significantly depending on your location and flood risk. The table below provides examples for several cities, including low-risk, average, and high-risk premiums:

| Location | Low-Risk Premium | Average Premium | High-Risk Premium |

|---|---|---|---|

| New York, NY | $250 | $650 | $2,400 |

| Los Angeles, CA | $180 | $550 | $1,950 |

| San Francisco, CA | $220 | $650 | $2,300 |

| San Diego, CA | $190 | $580 | $2,050 |

| Miami, FL | $300 | $800 | $3,000 |

| Orlando, FL | $210 | $600 | $2,200 |

| Houston, TX | $200 | $600 | $2,200 |

| Dallas, TX | $180 | $550 | $2,000 |

| Chicago, IL | $160 | $500 | $1,900 |

| Seattle, WA | $200 | $580 | $2,100 |

| Boston, MA | $220 | $620 | $2,250 |

| Washington, DC | $210 | $600 | $2,200 |

| Atlanta, GA | $180 | $550 | $2,000 |

| Nationwide Average | $150 | $600 | $2,000 |

Tips to Reduce Your Flood Insurance Costs

There are several strategies homeowners can use to manage flood insurance costs.

- Checking FEMA flood maps helps you understand your property’s risk level and discuss options with your insurance provider.

- Elevating key systems, such as HVAC units, electrical panels, and plumbing, reduces risk and may lower premiums.

- Installing protective measures, such as sump pumps and backflow valves, can also minimize potential damage.

- Considering a higher deductible can reduce annual premiums but increases out-of-pocket costs in the event of a claim

- Shopping around for private insurance may provide better rates or higher coverage limits.

- Purchasing coverage early is important because the thirty-day waiting period applies.

Who Needs Flood Insurance?

Flood insurance isn’t just for waterfront properties. It’s useful for:

- Homeowners in high-, moderate-, or even low-risk flood zones

- Renters, through contents-only policies

- Condo owners, who may need both building and contents coverage

- Commercial property owners or renters

Even homes without basements or those in urban areas can experience significant water damage from storms, drainage issues, or melting snow.

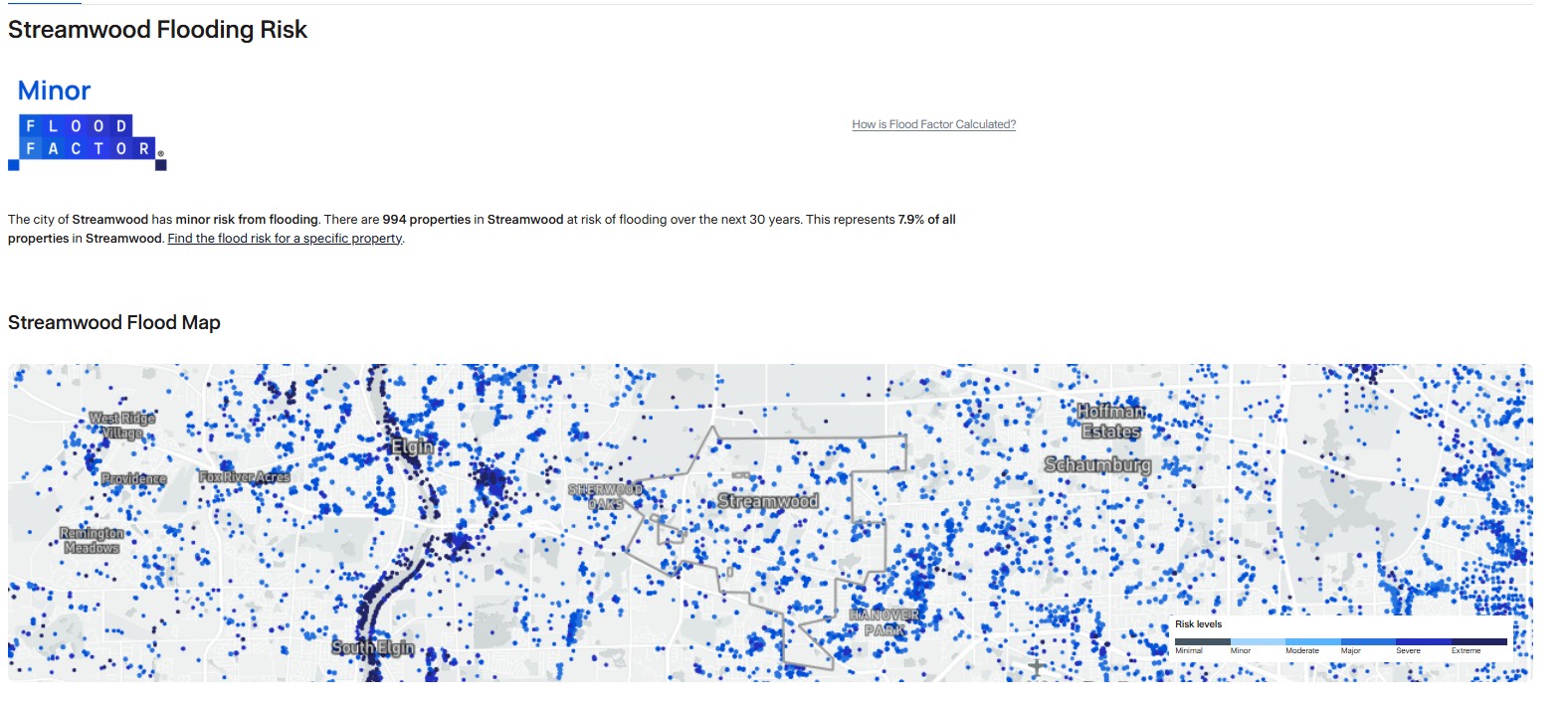

Understanding Your Flood Risk: FEMA Flood Maps

Before purchasing flood insurance, it’s essential to understand your home’s flood risk. FEMA provides detailed flood maps that categorize areas based on their likelihood of floodingFlooding is the overflow or accumulation of water in areas t... More. You can check your property by visiting the FEMA Flood Map Service Center at https://msc.fema.gov. Simply enter your address to see your location’s flood zone and risk level.

Flood Zone Categories and What They Mean

High-Risk Areas (Special Flood Hazard Areas – SFHAs)

- These zones have a 1% or greater chance of floodingFlooding is the overflow or accumulation of water in areas t... More each year.

- Homeowners in these areas usually face higher insurance premiums.

- Flood insurance is often required by lenders if you have a mortgage.

Moderate-Risk Areas

- These zones have a 0.2% to 1% annual chance of floodingFlooding is the overflow or accumulation of water in areas t... More.

- Insurance premiums are typically lower than high-risk zones, but coverage is still highly recommended.

Low-Risk Areas

- These zones are considered minimal risk but not risk-free.

- Premiums are often the most affordable, sometimes as low as $150 per year.

- About 20% of all flood claims come from low- to moderate-risk areas, so coverage is still important.

Step-by-Step Guide to Buying Flood Insurance

Getting flood insurance doesn’t have to be complicated. By breaking the process down into clear steps, you can protect your home and belongings without stress.

- Understand Your Flood Risk: Start by checking your property’s flood zone on FEMA’s Flood Map Service Center. Knowing whether you’re in a high-, moderate-, or low-risk area helps you make smart decisions about coverage.

- Look Over Your Current Insurance: Take a close look at your existing homeowners’ policy. Many people assume they’re fully covered, but most standard policies do not include floodingFlooding is the overflow or accumulation of water in areas t... More from rivers, storm surges, or groundwaterGroundwater is water that exists beneath the earth’s surfa... More. This step helps you identify gaps in your protection.

- Decide What You Need: Figure out whether you need building coverage, contents coverage, or both. Building coverage protects the structureStructure refers to the framework or components of a buildin... More of your home, while contents coverage safeguards your personal belongings like furniture, electronics, and important documents.

- Shop Around and Compare Options: Explore both the National Flood Insurance Program (NFIP) and private insurers. Compare premiums, coverage limits, and any extra benefits they offer. Getting multiple quotes ensures you find the best policy for your needs and budget.

- Choose Coverage Limits and Deductibles: Decide how much protection you want for your home and belongings, and pick a deductible that works for your finances. A higher deductible can lower your yearly premium, but it also means paying more out-of-pocket if a flood occurs.

- Buy Early to Be Protected: Flood insurance usually has a 30-day waiting period before it takes effect. Don’t wait until a storm is approaching—buy your policy early so you’re covered when you need it most.

Get Local Flood Cleanup Help Today

If your home has been affected by floodingFlooding is the overflow or accumulation of water in areas t... More, our local RestorationMaster experts are ready to help. We work directly with your flood insurance provider to make the process easier, so you can focus on getting your home restored.

Find a trusted flood cleanup contractor near you by entering your zip code. We accept flood insurance claims and provide fast, professional service to get your property back to normal. Don’t wait—connect with your local team today.

Frequently Asked Questions

How long does it take to get reimbursed after a flood?

Reimbursement times can vary depending on the insurer, the complexity of the claim, and the extent of the damage. With NFIP, claims are typically processed within 30 to 60 days, though complicated cases can take longer. Private insurance companies often aim for faster turnaround, sometimes processing claims within two to four weeks, especially if you have documentation and photos of the damage ready.

The key to a smooth claim process is being prepared. Take photos, make a detailed list of damaged items, keep receipts for temporary repairs, and contact your insurance adjuster as soon as possible. Staying organized can significantly reduce delays and ensure you get the money you need to repairRepair is the act of fixing or restoring damaged property, m... More your home quickly.

Can renters get flood insurance?

Yes, renters can purchase flood insurance, but it works a little differently than for homeowners. Renters’ flood insurance, also called contents-only coverage, protects your personal belongings inside the rental property. This can include furniture, electronics, clothing, appliances, and important documents.

It’s important to note that the landlord’s insurance typically covers the building itself, not your belongings. Renters’ flood insurance fills that gap, ensuring you aren’t left covering the cost of damaged items yourself. Policies are affordable, often ranging from $50 to $200 per year for low- to moderate-risk areas, making it a smart investment for anyone living in flood-prone regions.