Does Condo Insurance Cover Water Damage in Florida?

Summary: Condo insurance in Florida typically doesn’t cover water damage from floodingFlooding is the overflow or accumulation of water in areas t... More, which is common due to coastal storms. Residents are advised to consider purchasing separate flood insurance for added protection. Call water damage restorationWater damage restoration is the professional process of clea... More experts today for quick recovery and help in Florida.

Florida’s condo residents are aware of the perils of living in a coastal state. No matter how sunny and picturesque, the state is threatened continuously by hurricanes and natural disasters. Condo insurance may or may not cover water damage—as it all depends on the specifics of the policy.

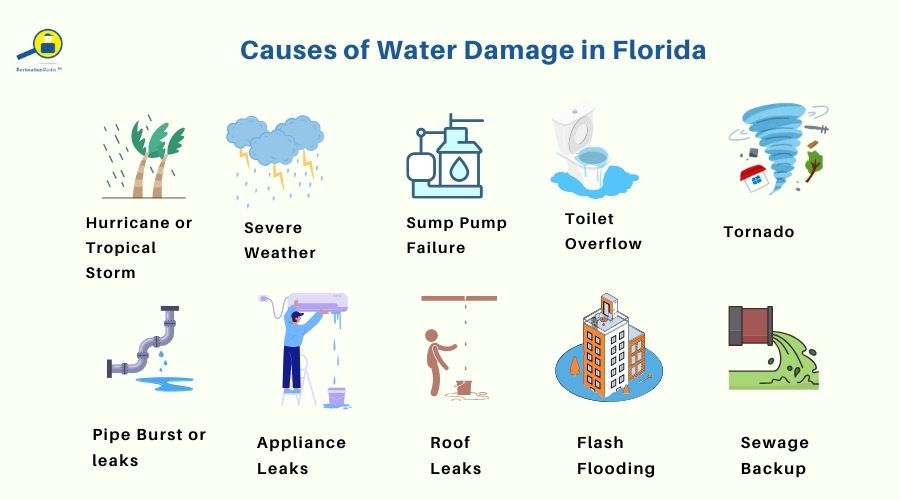

What types of water damage are common?

The Sunshine State is, in part, known for its destructive hurricanes. Since 2000, Florida has been ravaged by some 13 hurricanes and 79 tropical or extra-tropical storms. The 2024 Atlantic hurricane season is approaching on June 1 and can be expected to produce major water damage.

Severe weather is not the only threat to condos in Florida. Pipes within the property can rupture, spewing hundreds of gallons of water inside. The water heater can leak and appliances can malfunction. Accidentally letting the bathwater overflow can cause serious water damage, too.

FloodingFlooding is the overflow or accumulation of water in areas t... More and man-made fiascos destroy condos across the state. Condo residents naturally wonder if their condo insurance covers water damage. If the water damage is listed as a peril in the policy, the insurer will cover it. However, damages caused by floodingFlooding is the overflow or accumulation of water in areas t... More are not covered.

What are the benefits of purchasing condo insurance?

Condo residents in Florida are responsible for getting insurance for their unit, which includes the walls, floors, ceilings, and other structures inside. The condo association that owns the property insures the common areas, such as the lobbies, hallways, pools, fitness centers, and stairwells.

Condo insurance is essential for protection against the risks that the condo association’s insurance does not cover. Whether Florida’s condo residents are financially responsible for repairs caused by water damage is dependent on what caused the damage in the first place.

Insurable events are those that are sudden, unexpected, and unusual. Damages from these types of events may be caused by floods, fires, and hurricanes. On the other hand, damages may be caused by non-insurable events, such as negligence, wear and tear, and intentional acts.

When are condo residents responsible for water damage repairs?

When water damage occurs due to an insurable event, condo residents are responsible for the water damage repairs inside their unit. Residents with condo insurance can expect their insurer to cover the cost of interior repairs. An individual policy should cover damages not covered by the association’s policy.

Condo residents are responsible for the upkeep of the finished surfaces inside their unit. For example, if water damage destroys the walls or ceiling inside their unit, residents are responsible for the repainting and re-wallpapering—but not replacing the drywall.

Similarly, residents are tasked with replacing or repairing other interior structures, such as the kitchen cabinets, floor coverings, and personal property, when they are ruined by water damage. Window treatments, countertops, appliances, and electrical fixtures are included in their list of responsibilities.

Condo associations list and enforce rules that affect all residents, since they live in close proximity and use common facilities. When a resident violates a rule that leads to water damage, that individual is responsible for paying for the repairs—even for damages to the common elements.

When is the condo association responsible for repairs?

Essentially, if an insurable event causes water damage to the common areas, such as drywall and infrastructure, the condo association is responsible for the repairs and related costs. Using the example of drywall, the responsibility for replacing the damaged drywall falls to the condo association’s insurer.

Negligence on the condo association’s part makes them financially responsible for repairs to common areas. For example, a resident may complain of a roof leak. If the condo association fails to make proper repairs or perform adequate maintenanceMaintenance is the routine care, inspection, and repair of a... More, it is responsible for all damages.

Does condo insurance cover water damage?

As long as the damage is listed as a covered event in the insurance policy, condo residents can be assured it will be covered. Common covered events include burst pipes—but only when the damage is caused by accident. Residents prevent plumbing system failures by performing routine maintenanceMaintenance is the routine care, inspection, and repair of a... More.

If water leaks through the roof and into the unit, the condo insurance is likely to cover the damages. The cost of moldMold is a type of fungus that grows in damp or humid conditi... More removal may be covered when moldMold is a type of fungus that grows in damp or humid conditi... More colonies develop after a water damage incidentAn incident is an event or occurrence that causes damage, di... More. Be aware that moldMold is a type of fungus that grows in damp or humid conditi... More coverage may be minimal in a typical insurance policy.

What does condo insurance not cover?

As stated, condo insurance typically excludes coverage for water damage resulting from floodingFlooding is the overflow or accumulation of water in areas t... More, a common occurrence in Florida due to coastal storms. To safeguard against such risks, condo residents are encouraged to invest in separate flood insurance through the National Flood Insurance Program.

Securing supplemental flood insurance provides crucial financial protection for Florida’s condo residents in the event of severe storms or hurricanes causing floodingFlooding is the overflow or accumulation of water in areas t... More. By comprehending their responsibilities and thoroughly reviewing their insurance policy to understand coverage specifics, condo residents can ensure better protection against water damage.

Call experts for flood cleanup and water damage restoration

Even with precautionary measures and condo insurance in place, condo residents may still encounter significant water damage. In the event of a water damage disaster, our flood cleanup and water damage restorationWater damage restoration is the professional process of clea... More experts are equipped to swiftly clean and restore your property to its pre-damaged condition.

Efficient flood cleanup is paramount for both residential homes and commercial businesses. Our highly trained technicians utilize state-of-the-art water extraction equipment to eliminate all excess moisture from the property. Additionally, powerful dryingDrying is the process of removing moisture from materials, s... More machines are strategically placed throughout the affected area to ensure thorough dryingDrying is the process of removing moisture from materials, s... More.

Our professional technicians take it a step further by identifying the root cause of the water damage, whether it be a burst pipe or a malfunctioning appliance. Once the source of moisture is pinpointed, our skilled specialists promptly repairRepair is the act of fixing or restoring damaged property, m... More it to prevent further water intrusion and damage. Furthermore, we address any accompanying moldMold is a type of fungus that grows in damp or humid conditi... More growth to ensure comprehensive water damage restorationWater damage restoration is the professional process of clea... More.

Call water damage restoration experts in Florida today.