Understanding How Restoration Providers and Insurance Companies Collaborate

Executive Summary

Property damage recovery is governed by coordination rather than coverage alone. The quality of outcomes after water, fire, or environmental damage depends on how well restoration providers, insurance carriers, and claim administrators align their actions during the first critical days following a loss. Speed, technical accuracy, and documentation discipline determine whether a claim remains manageable or expands into a costly and complex event.

This white paper explains the operational relationship between restoration providers and insurers. It shows why restoration performance now functions as a core loss control mechanism within the property insurance system. It also explains how industry standards and professional documentation protect insurers, policyholders, and property owners by making recovery measurable, defensible, and predictable.

RestorationMaster operates within this system as a national quality and coordination platform. Its role is to ensure that restoration work meets professional standards while producing the documentation and communication that insurance carriers require to manage risk, close claims efficiently, and protect their policyholders.

The Scale and Cost of Property Damage Events

Water intrusion remains one of the most frequently reported perils in property insurance. According to industry data, approximately one out of every sixty seven insured homes in the United States files a water damage or freezing claim annually. These claims rank among the top causes of reported losses nationwide. (puroclean.com)

At a national level, industry figures indicate that the average insurance payout for water damage and freezing claims is frequently reported in the mid-five figures, representing a significant proportion of household property losses. Water and freezing damage events collectively represent nearly a quarter of all homeowners’ insurance claims. (puroclean.com)

Insurance professionals also report that tens of thousands of water damage incidents occur every day in the United States, reflecting both sudden catastrophic events and slower failures such as hidden leaks. (krapflegal.com)

These statistics demonstrate the scale of operational demand on both restoration providers and carriers as they work together to limit claim cost, preserve property condition, and support policyholder recovery.

Why Restoration Performance Matters to Insurers

Insurance carriers do not pay for drying or cleaning work on its own. They pay to stop ongoing damage and reduce uncertainty in claim outcomes.

Water intrusion continues to spread long after the original event. Moisture migrates through materials, microbial contamination expands, and structural components weaken if not addressed quickly. Restoration professionals are the only parties capable of objectively halting these processes.

Early mitigation limits secondary damage such as mold growth and corrosion, which are major drivers of claim cost escalation. Water loss can become exponentially more expensive if secondary damage is not arrested within a matter of days.

Beyond containment, restoration professionals generate the technical record upon which coverage decisions are based. Quality documentation supports coverage decisions, justifies scope and pricing, and defends claim decisions during audits or reviews.

The Role of Industry Standards

Professional restoration is governed by nationally recognized standards that define accepted practices for inspection, mitigation, and restoration. These standards are developed through consensus and are widely referenced by restoration professionals, carriers, and claims adjusters.

The ANSI/IICRC S500 Standard for Professional Water Damage Restoration is the industry benchmark for water mitigation work. It describes procedures to be followed and precautions to be taken when restoring structures affected by water intrusion, including residential, commercial, and institutional properties.

This standard also addresses how water damage should be classified and how drying systems should be designed, monitored, and documented. It establishes a science-based framework upon which restoration professionals build scope and measurement.

The IICRC Standards are internationally recognized and ANSI accredited. They cover best practices for inspection, cleaning, and restoration work in water, mold, and related exposures.

Documentation as the Foundation of Claim Integrity

Claims outcomes are driven by evidence rather than opinion. Restoration providers generate most of the technical documentation carriers rely on, including:

- Measured moisture content

- Temperature and humidity logs

- Photographic documentation of affected materials

- Classification of water contamination levels

- Equipment deployment logs and timelines

- Narrative explanations tied to standards

This documentation becomes part of the permanent claim file and supports coverage decisions, audit reviews, and potential disputes. When documentation is complete and aligned with recognized standards, insurers can close claims faster with greater certainty.

How Collaboration Works in Practice

The operational relationship between restoration providers and insurers typically unfolds in three phases:

Emergency Stabilization

Restoration professionals secure the site, mitigate immediate hazards, and begin controlled drying. They also inform carriers of conditions so that coverage and reserve decisions can begin.

Scope Definition and Documentation

Restoration professionals measure moisture, identify contamination, and document affected materials. This technical narrative allows carriers to evaluate the full extent of the loss and approve appropriate work.

Restoration and Claim Closure

Work proceeds according to the approved scope with structured documentation of progress and verification. If new damage is discovered, it is documented, communicated, and evaluated so that claim adjustments can be made without unnecessary delay.

Well-coordinated collaboration reduces cycle time, limits secondary damage, and enhances policyholder satisfaction.

In contrast, poor documentation often results in delayed approvals, frequent supplements, and increased administrative costs.

What Carriers Expect from Restoration Partners

Insurance carriers evaluate restoration partners based on their ability to deliver consistent technical performance, clear documentation, and reliable communication. What carriers value most includes:

- Compliance with established industry standards such as ANSI/IICRC S500

- Accurate measurement and classification of damage conditions

- Estimates that reflect the documented scope

- Effective communication about progress and changes

- Professional engagement with policyholders

Because the restoration provider is often the most visible aspect of the claim experience for the policyholder, their performance can affect both operational outcomes and brand perception.

Restoration professionals who follow these standards provide an objective basis for adjusters to evaluate scope, justify costs based on measurable conditions, and support claim defensibility.

RestorationMaster’s Role in the Ecosystem

RestorationMaster operates as a national quality and accountability platform for the restoration industry. We connect homeowners, commercial property owners, and facility managers with properly vetted restoration professionals who meet rigorous technical, licensing, and documentation standards.

RestorationMaster does not function as an insurance intermediary or contractor broker. Our role is to ensure that any restoration provider operating on our platform is properly trained, licensed, insured, and aligned with recognized industry standards before they are presented to a property owner.

Our model is designed to protect property owners and insurers by ensuring that restoration work is performed by qualified professionals who understand both the technical requirements of mitigation and the documentation requirements of the insurance claim process.

Our platform standards require that participating restoration contractors demonstrate:

- Restoration practices aligned with ANSI IICRC standards

- Proper state and local licensing and insurance

- Verified training and continuing education

- Consistent documentation and reporting procedures

- Professional communication with property owners and claim representatives

By maintaining this quality framework, RestorationMaster helps ensure that property owners receive competent and compliant restoration services while insurers receive the documentation and consistency they require to evaluate claims accurately.

This approach reduces the risk of improper mitigation, limits claim leakage, and improves the speed and reliability of property recovery across every market we serve.

What is Renters’ Insurance and What it Covers

Renters insurance is a type of insurance that covers the expense of restoring or replacing personal belongings from theft, fire damage, water damage, and vandalism when renting a space (such as an apartment). It can also cover the injuries of a guest or tenant on the property. Insurance agencies offer different policies when it comes to the amount and types of coverage involved.

While it is required to have renters’ insurance in all apartment buildings, many renters do not understand the full benefits that are included in the coverage. Many may see it as an unnecessary expense, however, it is actually one of the wisest forms of investment. From fire damage, vandalism, theft, water damage, and more, it can bring significant peace of mind when the unexpected occurs. Because it is most often used in apartment buildings, it is often considered much less expensive compared to home insurance, due to the smaller space and fewer belongings. Check out the following to learn more about renters’ insurance and what it covers in exchange for the small fee.

Common Occurrences Covered by Renter’s Insurance:

- Theft

- Smoke

- Vandalism

- Explosion

- Windstorm or hail

- Fire damage or lightning

- Falling objects

- Volcanic eruption

- Water damage

- Weight of snow, ice, or sleet

Additional Benefits of Renter’s Insurance

While many property renters are only aware that this insurance only covers tangible objects, however, it also offers additional coverage that is included in the small monthly fee. One of the most important types is liability insurance.

Liability Insurance

If a guest has hurt themselves in your home, they have the option to sue you as you are liable for the cause of the personal injury. Although you may want to consider never inviting this person over again, the lawsuit can take a severe toll on your finances. However, thanks to the liability insurance that is covered in the majority of standard plans, you are covered for personal injuries and property damage. But you will want to check with the insurance company in the case that your dog has bitten a guest as some policies do exclude this lawsuit.

In the case that your building was affected by a natural disaster, many insurance policies will also cover living expenses. While the water damage restoration or fire damage restoration service is working to repair the damage, you can have living expenses, such as a hotel, food, and other utilities paid by the insurance.

Disadvantages of Renter’s Insurance

While there are many benefits in renter’s insurance, you will have to pay extra if you would like to be covered in case of a flood or earthquake. But it is recommended for everyone living on the coast or near the mountains to consider it.

Understanding the Reimbursement Process

While many insurance companies will vary slightly, there are two different options for renters’ insurance policies:

- Cash Value: This includes the actual value of the item before it was damaged. Any depreciation that has occurred to the item before the event will be included in the cost. For example, a bed that is 5 years old will be worth less than the amount than at the time it was bought. Unfortunately, you will have to pay the difference if you want a new bed.

- Replacement cost: This will include the actual cost to replace each damaged item. For example, if your bed was destroyed, the insurance would cover the cost of a new bed that is of similar quality to the old one.

Of course, the cash value option is the most preferred, however, the insurance coverage cost is about 10% higher than the cash value cost. It all depends if you want brand new items instead of purchasing them used from a resale store.

There are also exceptions to every rule, such as high value jewelry theft. Policies may only cover up to a certain amount; therefore, you will want to discuss with your agent when choosing the policy that is best for you.

Keep an Inventory of Your Belongings for Renter’s Insurance

In order to get the most out of your insurance, it is best to keep an inventory of everything you own. This includes the item, its current value, the manufacturer, and the date it was purchased. As soon as you have documented all items, you can talk to your insurance agent about choosing the best plan for you that is based on this inventory.

Insurance Partners

While it is extremely important to have renters’ insurance as the coverage value certainly exceeds the monthly fee, it is also imperative to act right away to repair the damage. You can actually save more belongings at a lower cost when you immediately call a professional disaster restoration company. RestorationMaster is known for having one of the fastest response times when it comes to water damage restoration, fire damage restoration, and content cleaning. They will arrive on the scene quickly to prevent the damage from becoming permanent, allowing you to get more value out of your coverage than if any hesitation is taken. They also work with insurance companies during the claims process so you don’t have to worry about coordinating with different services. Finally, while it is important to have renters’ insurance, it is essential to call disaster restoration services right away in the event of a natural disaster.

Does Renter’s Insurance Cover Water Damage?

Renter’s insurance policies typically cover accidental water damage such as water leaks or burst pipes, but not damage from basement flooding or natural disasters. However, most renters insurance policies do not cover damages caused by flooding or sewage water, unless you paid for an extra add-on to your standard policy.

Does Renter’s Insurance Cover Water Damage?

Let’s explore what types of water damage are covered by renters insurance, and when you may need additional policies like flood insurance or water backup coverage.

- Bad Weather:

Most insurance companies cover the damage done to your personal belongings that may be due to inclement weather such as windstorms, lightning, hail, snow, ice, or sleet. This means if your apartment experiences water damage from a sewage line, or flooded basements, standard renters insurance won’t cover it unless you purchase extra coverage. Most of the time, earthquakes and floods are not covered and you would need to get an additional policy for that coverage. You should also understand how renters insurance claims for water damage work—especially if water leaks affect a neighboring unit. This means if you leave a window open during a storm, you are responsible for fixing it.

- Accidental Discharge of Water:

If it happens that you have an overflow or discharge of water in your home from a leaky appliance, burst pipe, water leak from your roof, or if water leaks to another unit from yours that causes damage to their property, that would be covered by your policy. However, if you do notice issues with piping, cracks in the wall, or something similar, you should make your landlord aware before further damage happens. To protect your belongings and avoid denied claims, document and report any water leak damage right away, including hidden ceiling leaks or mold risks.

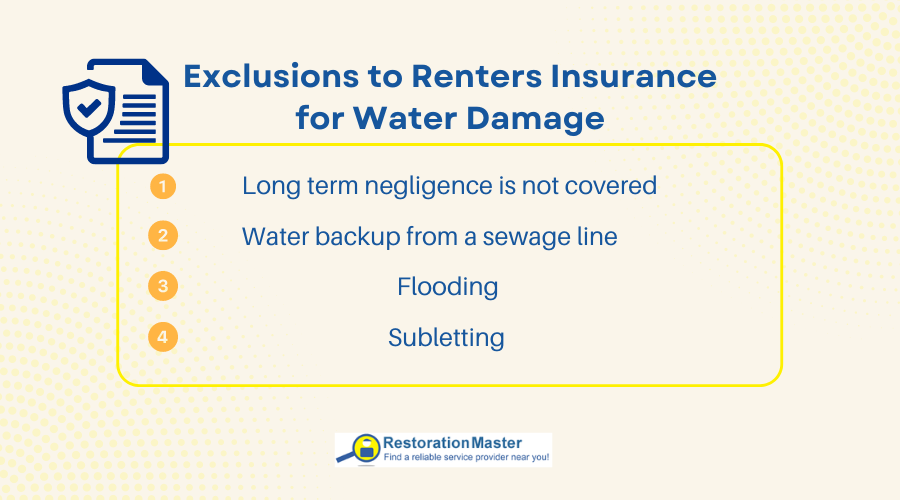

Exclusions to Renters Insurance

Be aware that long-term leaks and negligence-related water damage are typically not covered by renters insurance. For example, if you have flooding or sewage backup, typical renters insurance is not likely to cover the damage. Here are a few things to be aware of when it comes to exclusions to renter’s insurance:

Long term negligence is not covered:

Renter’s insurance covers accidental damage and does not cover any damages you’ve done yourself due to negligence or reckless behavior.

Water backup from a sewage line:

Usually, this type of damage is considered an add-on that needs to be purchased separately from the standard renter’s policy.

Flooding:

Renters insurance does not cover flooding, so if you live in a basement apartment or flood-prone area, you’ll need separate flood insurance. If you live in a flood zone make sure to purchase flood insurance.

Subletting:

If you sublet your rental, be sure to check if your renters insurance policy covers water damage in subletting situations, or if coverage is voided.

The point of renters insurance is to cover your personal property. However, your landlord is responsible for the following damages when it comes to the property:

- Plumbing

- Damage to the structure

- Electrical systems

- Appliances

Even if you are fully aware of what your renters policy covers, you should always check your policy on coverage when it comes to water damage. Most renters insurance policies cover only personal belongings and that includes things like jewelry, appliances, TVs, and laptops. For example, if your apartment has water damage and it is unlivable, your renters insurance should cover your living expenses, rental costs while you find a new apartment, and relocation costs such as laundry, food, etc. Always review your policy to see if it includes water damage coverage for issues like water backup, roof leaks, and overflowing appliances.

Should I Purchase Renter’s Insurance?

Renters insurance will protect your personal belongings so that you do not have to replace them yourself in case something happens to them. Some landlords may require you to carry renters insurance, especially in areas where pipe bursts, water leaks, or basement flooding are common. A lot of landlords now require you to purchase renters insurance as a part of the rental agreement.

Before purchasing renters insurance, you should create a home inventory list. This list will include all the items you own and details about them such as makes, models etc. Also, it should include their cost. This will help greatly with processing your claim and payout from your renters insurance company.

Something to be aware of before filing a renter’s policy insurance claim is your deductible. If the cost of the belongings that were damaged is less than the deductible, you should think about whether it is worth for you to file the claim as your insurance will not pay out anything below a deductible and your insurance premium may go up after filing a claim.

If you are facing water damage at your property and you need water damage restoration, call the professionals for water mitigation services. Highly trained technicians will clean, dry, and restore your property using hi-tech equipment while providing quality service. Calling a professional to deal with water damage as soon as it happens will limit the extent of the damage so you won’t have to file a large insurance claim.

Additional Resources and Claim Guidance

This white paper outlines the operational relationship between restoration providers and insurance carriers at a systems level. For readers seeking more detailed guidance on specific loss scenarios, coverage considerations, and restoration outcomes, the following resources provide additional context.

Understanding Water Damage Insurance Claims

Explains how water damage claims are evaluated, including common coverage distinctions between sudden and accidental losses versus long-term seepage, and how restoration documentation influences claim outcomes. Tips to maximize your claim.

Bad Faith Insurance Claims Explained

Reviews how bad faith practices can affect claim outcomes, what behaviors may constitute bad faith by carriers, and why complete, standards-based documentation matters in protecting policyholder rights.

Insurance Coverage for Biohazard and Specialty Cleaning

Provides a guide to how insurance policies treat biohazard, trauma, and other specialized cleaning losses, including common coverage nuances and documentation expectations.