Is Mold Damage Covered by Homeowner’s Insurance?

Most people are prudent enough to acknowledge the possibility of property damage and material loss from natural disasters or other accidents and make every effort to provide adequate protection against such unfortunate events – they secure their homes, maintain them in good overall condition, make disaster preparednessPreparedness is the state of being ready to respond to emerg... More plans, purchase homeowners’ insurance, etc. Such reasonable precautions can limit the extent of the damage and/or help people recover from a disaster in a quick and efficient manner (in the case of home insurance, for example).

Do you know for sure whether your insurance policy covers moldMold is a type of fungus that grows in damp or humid conditi... More?

It is taken for granted that whenever you experience some kind of damage, your homeowner’s insuranceHomeowner’s insurance is a policy that provides financial ... More will cover the restorationRestoration is the process of returning a property to its pr... More costs, easing the financial burden on your shoulders and providing you with the means to get your life back on track. However, this is not always the case. Standard home insurance policies don’t cover all types of damage – floods, earthquakes, and certain other perils, including moldMold is a type of fungus that grows in damp or humid conditi... More growth, require additional coverage.

MoldMold is a type of fungus that grows in damp or humid conditi... More is a very common problem (the moldMold is a type of fungus that grows in damp or humid conditi... More sporesSpores are microscopic reproductive units of fungi or mold t... More exist in the atmosphere as a natural part of the environment and can spawn and grow into a full colony within days under the right conditions – high humidityHumidity is the amount of moisture or water vapor present in... More level and an organic food source), so the large number of moldMold is a type of fungus that grows in damp or humid conditi... More claims during the last several decades comes as no surprise. The standard homeowner’s insuranceHomeowner’s insurance is a policy that provides financial ... More policy, however, only covers moldMold is a type of fungus that grows in damp or humid conditi... More damage if the moldMold is a type of fungus that grows in damp or humid conditi... More has occurred as a result of a covered peril.

Does Homeowner’s Insurance Cover Mold

While basic homeowner’s insurance typically excludes damage caused by fungiFungi are a group of organisms, including mold, mildew, and ... More and bacteria, moldMold is a type of fungus that grows in damp or humid conditi... More coverage varies from policy to policy:

- Some insurance policies contain exclusions, specifying that they will not cover mold removal and remediation, regardless of the source of the problem;

- Some policies cover moldMold is a type of fungus that grows in damp or humid conditi... More removal only under specific circumstances;

- Others have limitations on moldMold is a type of fungus that grows in damp or humid conditi... More coverage.

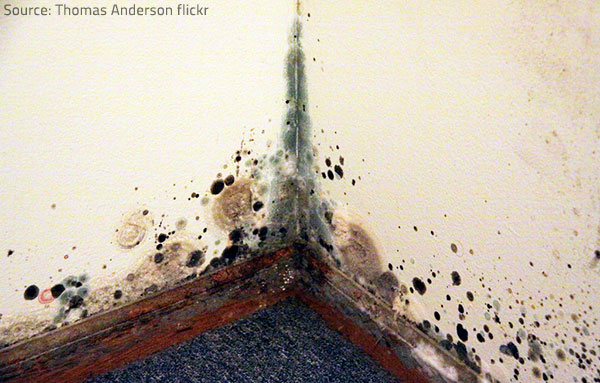

MoldMold is a type of fungus that grows in damp or humid conditi... More can cause severe structural damage and reduce the value of your home.

As a rule, homeowners insurance moldMold is a type of fungus that grows in damp or humid conditi... More coverage depends on the cause of the moldMold is a type of fungus that grows in damp or humid conditi... More problem. If moldMold is a type of fungus that grows in damp or humid conditi... More results from a covered water loss, such as the sudden or accidental discharge or overflow of water or steam from the plumbing system or a household appliance, the cost of mold remediationMold remediation is the process of identifying, removing, an... More will be covered under home insurance. That’s because the reason for the claim is the covered peril, not the moldMold is a type of fungus that grows in damp or humid conditi... More itself. The same is true for all types of covered perils:

- Burst pipes – homeowners policies usually cover sudden and accidental water issues, so you will be reimbursed for moldMold is a type of fungus that grows in damp or humid conditi... More damage resulting from the excessive moisture caused by a burst pipe;

- Storms – homeowners insurance won’t pay for water damage that results from a leaky roof but if a tree falls and crashes through the roof in the middle of a rain storm, that type of damage will be covered. In this case, your insurance policy will also cover any resulting moldMold is a type of fungus that grows in damp or humid conditi... More damage;

- Fires – homeowners insurance usually covers fire damage. So, if moldMold is a type of fungus that grows in damp or humid conditi... More results from the excessive water used to put out the fire, your insurance policy will probably cover the moldMold is a type of fungus that grows in damp or humid conditi... More removal as well;

- Sewer back up or sump pumpA sump pump is a pump installed in a basement or crawlspace ... More failure, if you have that coverage included in your insurance policy.

Standard insurance policies, however, do not cover water damage as a result of neglected home maintenanceMaintenance is the routine care, inspection, and repair of a... More – continuous water seepageSeepage is the slow movement of water or other fluids throug... More or repeat leaks, ongoing humidityHumidity is the amount of moisture or water vapor present in... More problems, landscaping or drainage problems, condensation, etc. Besides, most homeowner’s policies exclude flood damage, so moldMold is a type of fungus that grows in damp or humid conditi... More growth resulting from floodingFlooding is the overflow or accumulation of water in areas t... More will probably not be covered (unless you have specialized flood insurance).

Homeowner’s insuranceHomeowner’s insurance is a policy that provides financial ... More excludes coverage for ordinary moldMold is a type of fungus that grows in damp or humid conditi... More damage because it is not accidental – moldMold is a type of fungus that grows in damp or humid conditi... More growth can be prevented or controlled by the homeowner through home maintenanceMaintenance is the routine care, inspection, and repair of a... More and repairRepair is the act of fixing or restoring damaged property, m... More.

Coverage Limitations

Mold remediationMold remediation is the process of identifying, removing, an... More coverage is usually limited to a certain amount.

Even when moldMold is a type of fungus that grows in damp or humid conditi... More damage is covered, there may be limitations on the coverage. Most policies cap coverage at a certain amount – the amounts vary, depending on a number of factors, but a typical homeowner’s policy usually covers between $1,000 and $10,000 in mold remediationMold remediation is the process of identifying, removing, an... More and repairRepair is the act of fixing or restoring damaged property, m... More. Some insurers may offer higher amounts of coverage, especially if your policy includes additional endorsements.

To know for sure if your policy will cover moldMold is a type of fungus that grows in damp or humid conditi... More damage (and what kind of limits to expect), you need to read it very carefully and make sure you understand all the coverage details. If your policy doesn’t cover moldMold is a type of fungus that grows in damp or humid conditi... More removal and remediation, you may want to consider purchasing extra coverage. This may save you lots of headaches and thousands of dollars down the road.

Extra Mold Coverage

If you want to maximize your coverage, you can purchase a moldMold is a type of fungus that grows in damp or humid conditi... More rider as an add-on to your existing insurance policy. The premiums will vary, based on the area where you live (humid climates result in higher premiums) and the value of your home. Generally, newer homes will cost less to insure than older homes because modern constructions are considered less susceptible to water infiltrationInfiltration is the process by which water, air, or other su... More and are built with mold-resistant materials.

Have in mind that stand-alone policies that cover only moldMold is a type of fungus that grows in damp or humid conditi... More damage will be more expensive than standard homeowner’s insuranceHomeowner’s insurance is a policy that provides financial ... More policies with moldMold is a type of fungus that grows in damp or humid conditi... More riders (you can expect to pay from $500 to $1,500 a year for a rider on an existing policy).

Mold Remediation

Find out if your insurance policy will cover a moldMold is a type of fungus that grows in damp or humid conditi... More problem and take appropriate measures before it has become too late.

Have in mind that mold remediationMold remediation is the process of identifying, removing, an... More is a very difficult, expensive and laborious process. DIY moldMold is a type of fungus that grows in damp or humid conditi... More removal is usually inefficient and provides only a temporary solutionA solution is a homogeneous mixture of two or more substance... More to the problem. Only experienced mold remediation specialists can completely remove the moldMold is a type of fungus that grows in damp or humid conditi... More, remediate the related damage, and prevent moldMold is a type of fungus that grows in damp or humid conditi... More growth in the near future. They will ensure the excellent condition of your home and will guarantee that it remains mold-free for a long time. So, your investment in hiring professional mold removal services will pay off in the long run.

To be sure that your insurance will cover at least some of the related expenses, however, you need to find out in advance if your policy will cover a moldMold is a type of fungus that grows in damp or humid conditi... More problem if one arises. Do not wait until you discover moldMold is a type of fungus that grows in damp or humid conditi... More growth in your home to ask whether moldMold is a type of fungus that grows in damp or humid conditi... More is covered by homeowners insurance or not – review your policy, research your options, and provide the best possible protection for your property.