Water Damage Insurance Claim Tips: What You Need to Know

Water damage is one of those events that homeowners rarely see coming until it is right in front of them. A burst pipe, an overflowing washing machine, or a heavy storm can quickly turn a normal day into one filled with stress, soaked belongings, and the urgent need to act. Once the immediate mess is under control, the next step is figuring out how to deal with the insurance claim. If you’re not sure where to start, check out our guide on How to File an Insurance Claim for Water Damage.

Did you know that about 1 in 60 insured homes in the U.S. file a water-damage or freezing damage claim each year? Water damage and freezing together account for roughly 28% of all homeowners insurance claims, highlighting just how common these incidents are.

Most people understand the basic steps: notify the insurance company, take pictures, and wait for an adjuster. But what often determines whether a claim is paid fairly and without delays comes down to the details. Small mistakes or missing documentation can result in reduced payouts or even denials. Having worked with countless homeowners during this process, we have seen how preparationPreparation is the steps taken to ready a property, equipmen... More and thoroughness can make all the difference. For more tips on maximizing your payout, see How to Maximize Your Water Damage Insurance Claim.

Common Mistakes That Can Hurt a Water Damage Claim

In the rush to get things back to normal, homeowners often make quick decisions that hurt their claims. A few examples:

- Throwing things out right away. Even if something is clearly ruined, don’t toss it until your adjuster has seen it. They may want proof before they approve coverage.

- Jumping into permanent repairs. Stopping further damage is fine—like putting a tarp on the roof or using fans to dry out a room. But don’t replace drywall or flooring until the claim is documented.

- Calling it a “flood.” Insurance companies treat water damage and flood damage very differently. A broken pipe in your wall is water damage and usually covered. FloodingFlooding is the overflow or accumulation of water in areas t... More from outside your home requires a separate flood insurance policy. Using the wrong word can confuse or delay your claim. Learn more about coverage differences in How Does Homeowner’s Insurance Cover Water Damage?

and for commercial properties, see How Does Insurance Cover Commercial Water Damage?

Being careful at the start can save weeks of back-and-forth later.

Practical Steps to Strengthen Your Water Damage Insurance Claim

There are simple but powerful ways to make sure your claim doesn’t get pushed aside:

- Take thorough photos and videos. Don’t just snap a quick picture of a wet carpet. Get wide shots of entire rooms, close-ups of damaged furniture, and even short videos walking through the space.

- Keep every receipt. Insurance companies often reimburse expenses such as temporary lodging, sump pumpA sump pump is a pump installed in a basement or crawlspace ... More rentals, or even cleaning supplies. Many homeowners do not realize that these costs are covered and end up missing out on hundreds or even thousands of dollars in reimbursements. The average payout for a water damage claim is approximately $13,954, but severe cases, such as significant floodingFlooding is the overflow or accumulation of water in areas t... More or structural damage, can exceed $100,000.

- Write everything down. Keep a notebook where you log who you talked to, when, and what was said. Having a record helps if the insurance company pushes back later.

- Make a detailed list of what was damaged. Don’t just write “TV.” Write down the brand, size, year purchased, and cost. The more specific you are, the better.

Understanding Water Damage vs. Flood Damage

One of the biggest points of confusion for homeowners is the difference between water damage and flood damage. Water damage is caused by incidents inside the home, such as a leaking roof, burst pipe, or malfunctioning appliance. These situations are generally covered under a standard homeowners insurance policy.

Flood damage, however, comes from outside sources such as heavy rain, overflowing rivers, or storm surge. A standard homeowners policy does not cover this type of loss. Instead, flood coverage must be purchased separately through the National Flood Insurance Program or a private insurer. Knowing the difference before you call your insurance company helps you set realistic expectations about coverage and prevents unnecessary frustration.

Why Bringing in Restoration Professionals Helps

Recovering from water damage involves more than dryingDrying is the process of removing moisture from materials, s... More out carpets or patching up walls. One of the biggest challenges is making sure your insurance claim is handled correctly from the very beginning. Water Damage Restoration Companies that work with adjusters every day understand the type of documentation insurers want to see. They can prepare thorough reports, take moisture readings, and provide detailed repairRepair is the act of fixing or restoring damaged property, m... More estimates that help move the claim process forward.

Their support does not stop with paperwork. A professional restorationRestoration is the process of returning a property to its pr... More team can also speak directly with your insurance company on your behalf. This helps prevent long phone calls, repeated inspections, and unnecessary delays. At the same time, they manage the cleanup and repairs, allowing you to focus on your family and daily life instead of coordinating every step yourself.

Homeowner Water Damage Checklist

To help you stay organized and protect your claim, here’s a quick checklist to follow immediately after discovering water damage:

- Check for safety hazards – Turn off electricity and water if needed, and avoid standing in water near outlets.

- Stop the source – Shut off the main water supply or address leaks to prevent further damage.

- Document everything – Take photos and videos of all affected areas from multiple angles.

- Create a damage inventory – List every damaged item with brand, size, age, and estimated value.

- Keep all receipts – Save receipts for repairs, cleanup, lodging, and temporary equipment rentals.

- Avoid permanent repairs – Do only emergency measures like dryingDrying is the process of removing moisture from materials, s... More, mopping, or tarping.

- Contact your insurance company immediately – Provide details of the damage and request a claim number.

- Maintain a written record of communications – Note dates, names, and summaries of all calls and emails.

- Consider professional restorationRestoration is the process of returning a property to its pr... More help – RestorationMaster Experts can handle water damage repairs and assist with your claim documentation.

- Monitor for additional damage – Check for hidden issues such as moldMold is a type of fungus that grows in damp or humid conditi... More growth or structural weakening.

Commonly Asked Questions

Will filing a claim raise my insurance rates?

It might, but not always. One small claim usually won’t have much effect. Bigger claims or repeated incidents could increase your premium. Check with your insurer so you know what to expect.

How long does it take for a water damage claim to be resolved?

It varies depending on the extent of damage and your insurer’s process. Small claims may be settled in a few weeks, while larger or more complicated cases can take several months. Having thorough documentation and professional restorationRestoration is the process of returning a property to its pr... More reports can speed up the process.

How to Maximize Your Water Damage Insurance Claim – Video

Water damage is a frequent issue in US households. In fact, one in 50 insured homes is affected by water damage each year. Insurers are likely to attempt to underpay or deny a claim. Here’s how homeowners can maximize their water damage insurance claim.

Understanding Water Damage

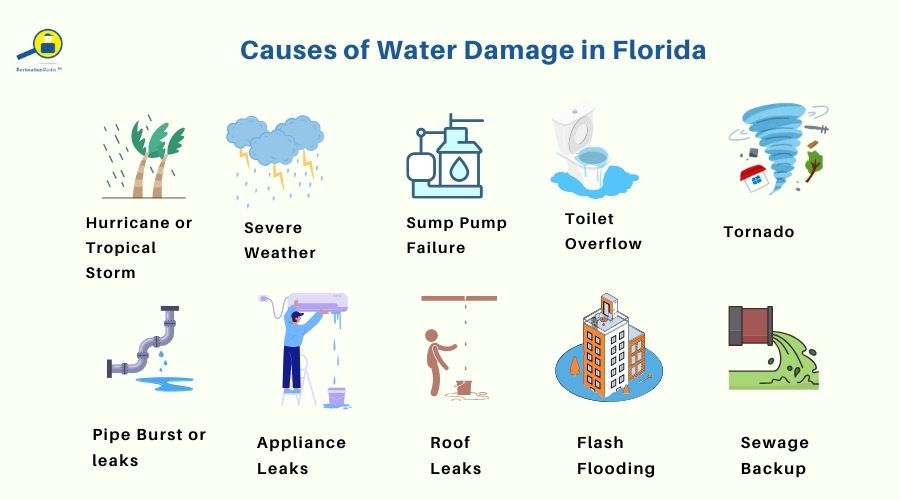

Dishwashers, water heaters, washing machines, and refrigerators are common household appliances that can leak and cause significant water damage to the surrounding areas. Homeowners who ignore signs of appliance malfunction may experience water damage.

Additionally, faulty plumbing systems can leadLead is a heavy metal that can be toxic to humans, especiall... More to water damage. In areas like the Midwest, where frigid winters are common, burst pipes are a frequent issue. Unaddressed leaks in pipes can also result in severe water damage.

Severe rainstorms, overflowing rivers, and hurricanes can leadLead is a heavy metal that can be toxic to humans, especiall... More to floodingFlooding is the overflow or accumulation of water in areas t... More and water damage throughout the home. FloodingFlooding is the overflow or accumulation of water in areas t... More is a major concern, especially if the sump pumpA sump pump is a pump installed in a basement or crawlspace ... More fails. Similarly, sewageSewage is wastewater containing biological and chemical cont... More backups can push water into the home, causing damage.

Structural damage can be significant when building materials are exposed to moisture for extended periods. If water damage from any of these scenarios is not promptly repaired, walls and floors can warp and rot. MoldMold is a type of fungus that grows in damp or humid conditi... More can begin to grow within 24 to 48 hours.

Different Types of Water Damage Insurance

Here are the main types of water damage insurance coverage you should be aware of:

- Homeowners Insurance: This type of insurance typically covers water damage caused by sudden and accidental incidents such as burst pipes, appliance malfunctions, or accidental overflows. For instance, if your washing machine leaks and causes damage to your floors and walls, your homeowners insurance can help cover the repairRepair is the act of fixing or restoring damaged property, m... More costs. However, it’s important to note that homeowners insurance usually doesn’t cover damage from floodingFlooding is the overflow or accumulation of water in areas t... More, which is a separate risk.

- Flood Insurance: Flood insurance is specifically designed to cover damage from floodingFlooding is the overflow or accumulation of water in areas t... More, which can occur due to heavy rains, storms, or rising rivers. This type of insurance is essential if you live in a flood-prone area. Standard homeowners insurance generally does not cover flood damage, so you may need to purchase flood insurance separately to protect your home and belongings.

- Renters Insurance: If you’re renting a home or apartment, renters insurance can help cover water damage to your personal belongings. For example, if a leak from an upstairs apartment damages your furniture and electronics, renters insurance can help you replace these items. However, renters insurance does not cover damage to the building itself.

- Condo Insurance: Condominium insurance provides coverage for your personal property within your condo and may also cover damage to the condo’s interior structureStructure refers to the framework or components of a buildin... More, depending on the policy. This is important if you’re a condo owner and need protection for both your belongings and the parts of the building that you are responsible for.

- Building Property Insurance: For commercial properties, building property insurance covers water damage to the structureStructure refers to the framework or components of a buildin... More and contents of the building. This is crucial for businesses to protect against damage from internal water sources, like pipe leaks or malfunctioning equipment.

- Umbrella Insurance: Umbrella insurance offers an extra layer of protection beyond what is covered by standard policies. It can provide broader coverage for various risks, including water damage. This type of insurance is beneficial if you want additional security, particularly if you face higher risks or have significant assets to protect.

Does Condo Insurance Cover Water Damage in Florida?

Summary: Condo insurance in Florida typically doesn’t cover water damage from floodingFlooding is the overflow or accumulation of water in areas t... More, which is common due to coastal storms. Residents are advised to consider purchasing separate flood insurance for added protection. Call water damage restorationWater damage restoration is the professional process of clea... More experts today for quick recovery and help in Florida.

Florida’s condo residents are aware of the perils of living in a coastal state. No matter how sunny and picturesque, the state is threatened continuously by hurricanes and natural disasters. Condo insurance may or may not cover water damage—as it all depends on the specifics of the policy.

What types of water damage are common?

The Sunshine State is, in part, known for its destructive hurricanes. Since 2000, Florida has been ravaged by some 13 hurricanes and 79 tropical or extra-tropical storms. The 2024 Atlantic hurricane season is approaching on June 1 and can be expected to produce major water damage.

Severe weather is not the only threat to condos in Florida. Pipes within the property can rupture, spewing hundreds of gallons of water inside. The water heater can leak and appliances can malfunction. Accidentally letting the bathwater overflow can cause serious water damage, too.

FloodingFlooding is the overflow or accumulation of water in areas t... More and man-made fiascos destroy condos across the state. Condo residents naturally wonder if their condo insurance covers water damage. If the water damage is listed as a peril in the policy, the insurer will cover it. However, damages caused by floodingFlooding is the overflow or accumulation of water in areas t... More are not covered.

What are the benefits of purchasing condo insurance?

Condo residents in Florida are responsible for getting insurance for their unit, which includes the walls, floors, ceilings, and other structures inside. The condo association that owns the property insures the common areas, such as the lobbies, hallways, pools, fitness centers, and stairwells.

Condo insurance is essential for protection against the risks that the condo association’s insurance does not cover. Whether Florida’s condo residents are financially responsible for repairs caused by water damage is dependent on what caused the damage in the first place.

Insurable events are those that are sudden, unexpected, and unusual. Damages from these types of events may be caused by floods, fires, and hurricanes. On the other hand, damages may be caused by non-insurable events, such as negligence, wear and tear, and intentional acts.

When are condo residents responsible for water damage repairs?

When water damage occurs due to an insurable event, condo residents are responsible for the water damage repairs inside their unit. Residents with condo insurance can expect their insurer to cover the cost of interior repairs. An individual policy should cover damages not covered by the association’s policy.

Condo residents are responsible for the upkeep of the finished surfaces inside their unit. For example, if water damage destroys the walls or ceiling inside their unit, residents are responsible for the repainting and re-wallpapering—but not replacing the drywall.

Similarly, residents are tasked with replacing or repairing other interior structures, such as the kitchen cabinets, floor coverings, and personal property, when they are ruined by water damage. Window treatments, countertops, appliances, and electrical fixtures are included in their list of responsibilities.

Condo associations list and enforce rules that affect all residents, since they live in close proximity and use common facilities. When a resident violates a rule that leads to water damage, that individual is responsible for paying for the repairs—even for damages to the common elements.

When is the condo association responsible for repairs?

Essentially, if an insurable event causes water damage to the common areas, such as drywall and infrastructure, the condo association is responsible for the repairs and related costs. Using the example of drywall, the responsibility for replacing the damaged drywall falls to the condo association’s insurer.

Negligence on the condo association’s part makes them financially responsible for repairs to common areas. For example, a resident may complain of a roof leak. If the condo association fails to make proper repairs or perform adequate maintenanceMaintenance is the routine care, inspection, and repair of a... More, it is responsible for all damages.

Does condo insurance cover water damage?

As long as the damage is listed as a covered event in the insurance policy, condo residents can be assured it will be covered. Common covered events include burst pipes—but only when the damage is caused by accident. Residents prevent plumbing system failures by performing routine maintenanceMaintenance is the routine care, inspection, and repair of a... More.

If water leaks through the roof and into the unit, the condo insurance is likely to cover the damages. The cost of moldMold is a type of fungus that grows in damp or humid conditi... More removal may be covered when moldMold is a type of fungus that grows in damp or humid conditi... More colonies develop after a water damage incidentAn incident is an event or occurrence that causes damage, di... More. Be aware that moldMold is a type of fungus that grows in damp or humid conditi... More coverage may be minimal in a typical insurance policy.

What does condo insurance not cover?

As stated, condo insurance typically excludes coverage for water damage resulting from floodingFlooding is the overflow or accumulation of water in areas t... More, a common occurrence in Florida due to coastal storms. To safeguard against such risks, condo residents are encouraged to invest in separate flood insurance through the National Flood Insurance Program.

Securing supplemental flood insurance provides crucial financial protection for Florida’s condo residents in the event of severe storms or hurricanes causing floodingFlooding is the overflow or accumulation of water in areas t... More. By comprehending their responsibilities and thoroughly reviewing their insurance policy to understand coverage specifics, condo residents can ensure better protection against water damage.

Call experts for flood cleanup and water damage restoration

Even with precautionary measures and condo insurance in place, condo residents may still encounter significant water damage. In the event of a water damage disaster, our flood cleanup and water damage restorationWater damage restoration is the professional process of clea... More experts are equipped to swiftly clean and restore your property to its pre-damaged condition.

Efficient flood cleanup is paramount for both residential homes and commercial businesses. Our highly trained technicians utilize state-of-the-art water extraction equipment to eliminate all excess moisture from the property. Additionally, powerful dryingDrying is the process of removing moisture from materials, s... More machines are strategically placed throughout the affected area to ensure thorough dryingDrying is the process of removing moisture from materials, s... More.

Our professional technicians take it a step further by identifying the root cause of the water damage, whether it be a burst pipe or a malfunctioning appliance. Once the source of moisture is pinpointed, our skilled specialists promptly repairRepair is the act of fixing or restoring damaged property, m... More it to prevent further water intrusion and damage. Furthermore, we address any accompanying moldMold is a type of fungus that grows in damp or humid conditi... More growth to ensure comprehensive water damage restorationWater damage restoration is the professional process of clea... More.

Call water damage restoration experts in Florida today.

How to File a Water Damage Insurance Claim: Step-by-Step Guide

For first-time homeowners, filing an insurance claim may feel confusing and stressful. Knowing the exact steps, required documentation, and timelines can save you time, money, and frustration. Here’s a detailed guide from a restorationRestoration is the process of returning a property to its pr... More expert’s perspective.

1. Call Your Insurance Company Right Away

The first thing you should do is contact your insurer as soon as you notice the damage. Early reporting keeps your claim on track.

- Have your policy number ready.

- Explain clearly what happened and where the damage is.

- Ask for any specific forms your insurance company requires.

- Note deadlines—most policies expect claims to be filed within 30 to 60 days.

Tip from experience: Keep a notebook or phone log of all calls. Write down the date, the name of the person you spoke to, and what was discussed. This record can save you a lot of for future tracking purposes.

2. Document the Damage Thoroughly

Insurance companies need clear evidence. The more detailed your documentation, the stronger your claim.

Take wide-angle and close-up photos of every affected area—ceilings, walls, floors, and furniture.

- Record short videos walking through damaged rooms to show context.

- Preserve any broken materials or items that contributed to the damage (like a pipe or appliance).

- Note the timeline of events—when the damage occurred, what steps were taken, and any further incidents.

- Do not throw away items until an adjuster has inspected them. Even seemingly minor items can affect reimbursement.

3. Take Emergency Measures to Limit Further Damage

Most insurance policies allow you to take immediate actions to prevent additional harm without affecting your claim:

- Shut off water and electricity if safe.

- Remove standing water with mops, pumps, or wet/dry vacuums.

- Use fans or dehumidifiers to dry affected areas.

- Cover damaged roofs or openings with tarps.

- Move valuables and sensitive items to a dry, safe area.

4. Review Your Insurance Coverage

Before filing, understand exactly what your policy covers. Typical water damage coverage may include:

- Burst pipes or appliance leaks

- HVAC or plumbing-related water damage

- Sewer or drain backups (sometimes requires additional coverage)

- Temporary living expenses if your home is uninhabitable

- RepairRepair is the act of fixing or restoring damaged property, m... More or replacement of personal property and structural components

5. Create a Detailed Inventory of Damaged Property

A comprehensive inventory ensures your claim is accurate:

- Record brand, model, age, and condition of each item.

- Include replacement cost and current value.

- Attach receipts, photos, or proof of purchase whenever possible.

- Note any sentimental or high-value items that may require extra attention.

6. File Your Written Claim

Once your documentation is ready, submit your claim in writing:

- Complete the insurer’s claim form thoroughly.

- Attach all photos, videos, receipts, and inventory lists.

- Keep copies of everything you submit for your records.

For additional guidance, check out Common Mistakes That Can Hurt a Water Damage Claim

to ensure your claim isn’t delayed or denied.

7. Cooperate with the Insurance Adjuster

The adjuster will inspect your property to confirm the damage. Be present to:

- Point out all affected areas, even minor ones.

- Provide additional documentation if requested.

- Discuss temporary repairs or living arrangements if necessary.

8. Understand the Settlement Process

After inspectionInspection is the careful examination and assessment of a pr... More, your insurer will issue a settlement:

- Replacement cost policies cover repairRepair is the act of fixing or restoring damaged property, m... More or replacement minus your deductible.

- Actual cash value policies subtract depreciation.

- Any upgrades beyond original materials are typically out-of-pocket.

9. Restore Your Home Professionally

Water damage affects structural elements, furniture, flooring, and more. Professional restorationRestoration is the process of returning a property to its pr... More ensures:

- Complete water extraction and dryingDrying is the process of removing moisture from materials, s... More

- RepairRepair is the act of fixing or restoring damaged property, m... More of walls, floors, and structural components

- Cleaning and deodorizing carpets and upholstery

- MoldMold is a type of fungus that grows in damp or humid conditi... More preventionPrevention refers to actions taken to reduce the likelihood ... More and remediation

10. Manage Temporary Living Arrangements

If your home is uninhabitable, your policy may cover temporary housing, meals, and essential expenses.

- Track all costs carefully.

- Use vendors that can bill your insurer directly whenever possible.

- Stay within policy limits to avoid out-of-pocket expenses.

How Your Water Damage Claim Settlement is Calculated

When it comes to water damage, not all insurance policies pay the same way. Understanding the difference can help you avoid surprises and plan your repairs properly.

| Type of Policy | What It Covers | What You Might Pay Yourself |

|---|---|---|

| Replacement Cost | Pays to repairRepair is the act of fixing or restoring damaged property, m... More or replace damaged items or parts of your home at today’s prices, minus your deductible. | Any upgrades beyond what was originally there, like higher-end flooring, cabinets, or fixtures. |

| Actual Cash Value (ACV) | Pays the current value of the damaged item after accounting for age and wear. | The difference between replacement cost and what the insurance pays, plus any upgrades you choose. |

Example:

Suppose a 12-year-old dishwasher leaks, floodingFlooding is the overflow or accumulation of water in areas t... More the kitchen and damaging hardwood flooring and cabinets.

| Item | Original Cost | Depreciation (ACV) | Insurance Payout (ACV) | Replacement Cost Payout | Out-of-Pocket |

|---|---|---|---|---|---|

| Hardwood Flooring | $5,000 | 50% | $2,500 | $5,000 | $0 (minus deductible) |

| Cabinets | $3,000 | 40% | $1,800 | $3,000 | $0 (minus deductible) |

| Dishwasher | $1,000 | 30% | $700 | $1,000 | $0 (minus deductible) |

How to interpret this:

- ACV policy: You receive the depreciated value ($5,000 total). If you want new materials or upgrades, you pay the difference.

- Replacement cost policy: You get enough to restore your home to its original state ($9,000 total), minus your deductible. Any upgrades beyond the original materials would be your responsibility.

Find Local Contractors on RestorationMaster and Get Help With Filing Insurance Claims

Find experienced local contractors on RestorationMaster who know how to handle water damage restoration from start to finish. They’ll take care of repairs, secure your home, and help you organize and submit your insurance claim, so you don’t have to navigate the process alone.

Frequently Asked Questions

What if my claim is denied?

You have the right to appeal or file a complaint with your state insurance department. Provide all documentation and consider hiring a public adjuster if you need assistance negotiating.

Can I file a claim for water damage caused by my neighbor’s property?

Yes. If the water damage originates from another property, your insurer may pursue subrogation to recover costs from the responsible party. Make sure to document everything and provide your insurer with detailed information.

How should I handle water damage in a rental property I own?

Landlord insurance typically covers structural damage, but tenants’ personal property is not included. You need to encourage tenants to report incidents immediately and document damages thoroughly.

What happens if I find hidden water damage months later?

You can notify your insurer as soon as water damage is discovered. While some policies set strict time limits for filing claims, reporting promptly and providing detailed evidence greatly increases the likelihood of coverage—especially if the damage stems from a covered event.